Berkshire Hathaway

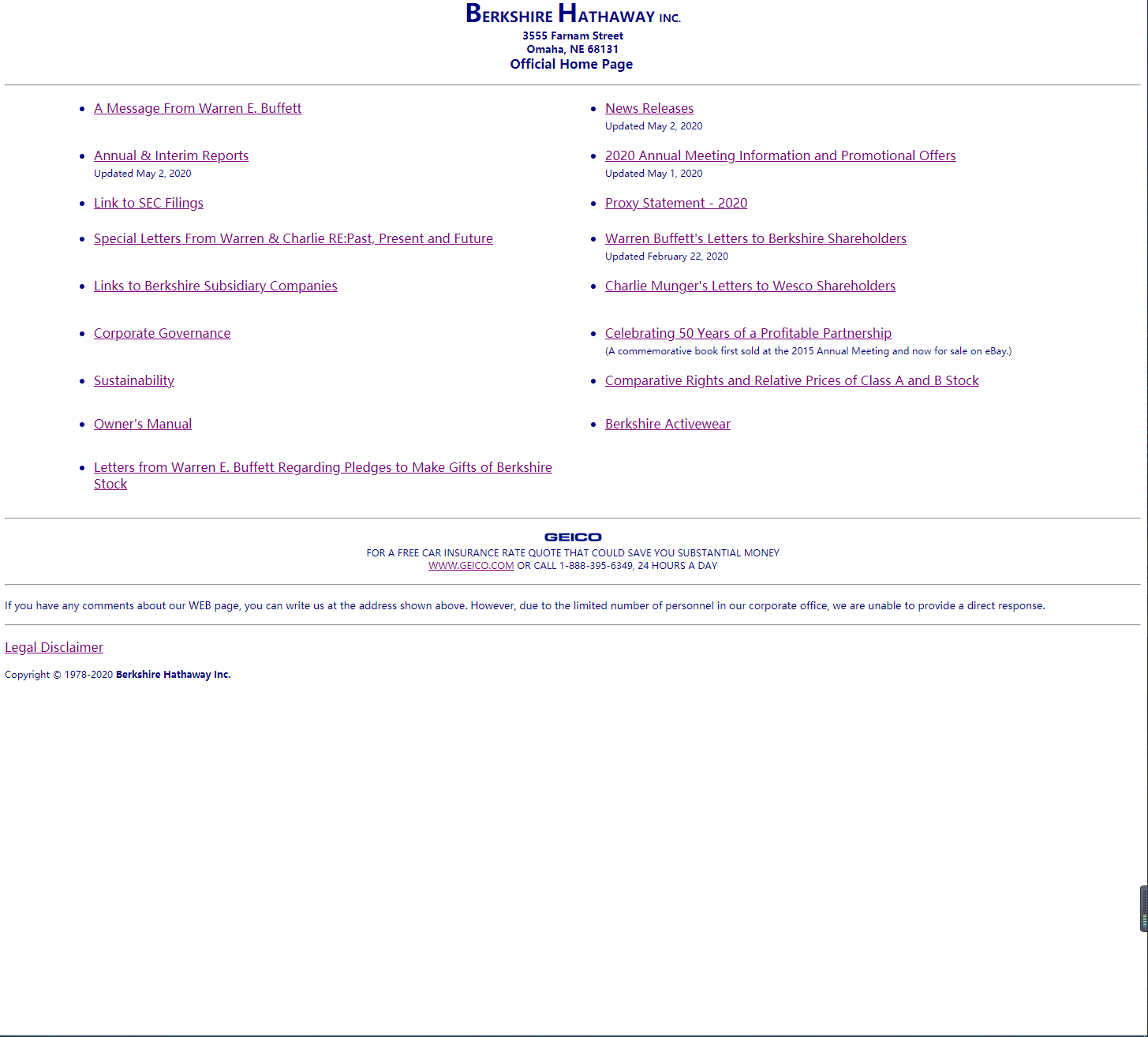

Business Menu Page | Berkshire Hathaway

"Berkshire Hathaway is an American multinational corporation holding business headquartered in Omaha, Nebraska, USA. The company wholly possesses GEICO, Duracell, Dairy Queen, BNSF, Lubrizol, Fruit of the Loom, Helzberg Diamonds, Long & Foster, FlightSafety International, Pampered Chef, Forest River and also NetJets, as well as also owns 38.6% of Pilot Traveling J; and significant minority holdings in U.S. public business Kraft Heinz Company (26.7%), American Express (17.6%), Wells Fargo (9.9%), The Coca-Cola Firm (9.32%), Financial Institution of America (6.8%), and also Apple (5.22%). [4] Starting in 2016, the business got huge holdings in the major United States airline company carriers, namely United Airlines, Delta Air Lines, Southwest Airlines and also American Airlines [5] yet offered every one of its airline company holdings early in 2020. [6] Berkshire Hathaway has averaged a yearly development in book value of 19.0% to its investors since 1965 (contrasted to 9.7% from the S&P 500 with rewards included for the same duration), while utilizing huge quantities of capital, and also marginal financial debt.

The firm is recognized for its control and also leadership by Warren Buffett, that acts as chairman and also president, and by Charlie Munger, among the business's vice-chairmen. In the very early part of his occupation at Berkshire, Buffett focused on long-term investments in publicly traded firms, however more just recently he has a lot more regularly gotten whole firms. Berkshire now has a diverse variety of services including confectionery, retail, railroads, furniture, encyclopedias, producers of hoover, jewelry sales, manufacture as well as circulation of uniforms, and several regional electric as well as gas energies.

According to the Forbes Global 2000 listing as well as formula, Berkshire Hathaway is the 3rd biggest public business in the world, the tenth largest empire by earnings and also the biggest financial solutions firm by revenue in the world.

As of April 2020, Berkshire's Class B supply is the eighth-largest element of the S&P 500 Index (which is based upon free-float market capitalization) as well as the firm is well-known for having the most costly share price in background with Course A shares setting you back around $300,000 each. This is due to the fact that there has actually never been a supply split in its Course A shares and also Buffett specified in a 1984 letter to shareholders that he does not intend to split the stock."

The firm is recognized for its control and also leadership by Warren Buffett, that acts as chairman and also president, and by Charlie Munger, among the business's vice-chairmen. In the very early part of his occupation at Berkshire, Buffett focused on long-term investments in publicly traded firms, however more just recently he has a lot more regularly gotten whole firms. Berkshire now has a diverse variety of services including confectionery, retail, railroads, furniture, encyclopedias, producers of hoover, jewelry sales, manufacture as well as circulation of uniforms, and several regional electric as well as gas energies.

According to the Forbes Global 2000 listing as well as formula, Berkshire Hathaway is the 3rd biggest public business in the world, the tenth largest empire by earnings and also the biggest financial solutions firm by revenue in the world.

As of April 2020, Berkshire's Class B supply is the eighth-largest element of the S&P 500 Index (which is based upon free-float market capitalization) as well as the firm is well-known for having the most costly share price in background with Course A shares setting you back around $300,000 each. This is due to the fact that there has actually never been a supply split in its Course A shares and also Buffett specified in a 1984 letter to shareholders that he does not intend to split the stock."

Features I like:

No

Features I don't like:

No